Shout-out to reporter Noelle Philips of the Denver Post for a thorough article. Apparently a company named CoreLogic also has a model of wildfire risk. Count me skeptical, and I’m not the only one. How convenient that the model ignores mitigation and suppression! could that lead to a mismatch between real and perceived risk.. in whose favor? Let me think..

It’s interesting that organizations who benefit from higher rates also believe in (and paid for?) them..

Carole Walker, executive director of the Rocky Mountain Insurance Association, said the various data reports generated by tech companies are really reflecting what insurance companies already know — hot, dry weather in Colorado is increasing the chances of wildfires and still people are building expensive homes in the mountains.

She disputed arguments that the various analyses cause rates to go up.

“What it really does is provide accuracy, first and foremost, for what your risk is,” Walker said.

According to Wikipedia:

CoreLogic, Inc. is an Irvine, CA based leading information services provider of financial, property, and consumer information, analytics, and business intelligence. The company analyzes information assets and data to provide clients with analytics and customized data services.

******************

Modeling isn’t new

Computer modeling for wildfire risk is fairly new to the industry, Walker said.

It is much more sophisticated than years ago when a homeowner would talk with their insurance agent about how far they lived from the nearest fire station and where fire hydrants were located in neighborhoods. Now, drones, satellite imagery and other data points can help analyze the slope on which a home is built, the vegetation around the house, construction materials and, yes, the distance to the closest fire station.

Those models also are helping with the science of mitigation, which is an increasingly big part of reducing wildfire risk, she said.

That means homeowners do as much as they can to reduce the chances their houses will burn in a wildfire. It involves everything from upgrading roofs to moving wooden fences farther from houses to clear-cutting dense brush around the perimeters of homes.

But that’s where the fight is centered. If insurance companies are going to ask homeowners to mitigate risk, then the homeowners should receive discounts for that work, Conway said.

So far, the risk analyses and modeling programs that insurance companies rely on are not taking into account all that work, he said.

For example, Colorado deployed a Firehawk helicopter for the first time to fight blazes that sparked this summer in Boulder, Jefferson and Larimer counties. The state’s Division of Fire Prevention and Control also has airplanes to map fires and carry water and retardants to extinguish them. Those aviation assets saved valuable property.

But the state and its homeowners do not get credit in risk assessments for those airplanes and the helicopter, Conway said.

The models also don’t take into account all the work that communities such as Boulder County have done to help reduce the level of destruction a wildfire can cause. For example, Boulder County collected $8.9 million last year through a sales tax dedicated to wildfire mitigation that funds projects such as using goats to graze on open space in Superior.

The same fight is happening in California, Bach said. It’s impossible to put the “tech genie back in the bottle,” so it is up to regulators like Conway to push the tech companies to change their models and predictions so mitigation efforts are included in the assessments, she said.

“That is the fight,” Bach said. “From my perspective as a consumer advocate, if you’re charging someone who has mitigated the same rate as someone who hasn’t, then you’re overcharging.”

I hope insurance regulators hire someone to ground-truth risk maps.

*********************

Below is the whole story as requested by Pecos:

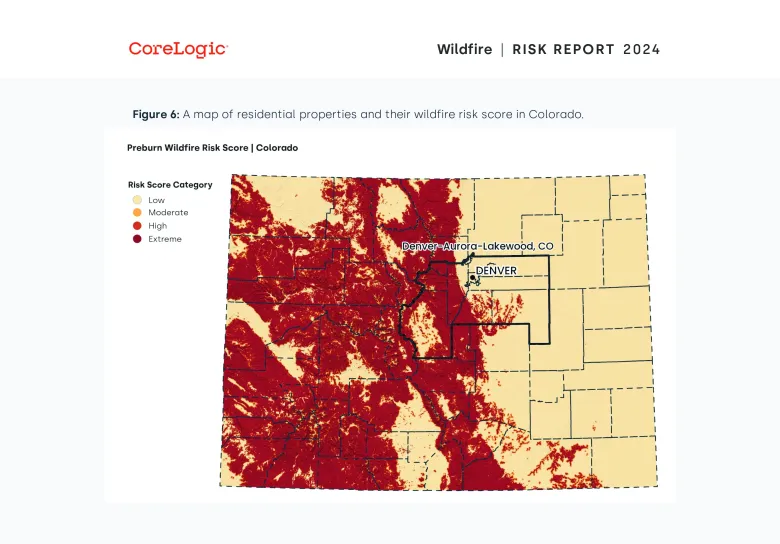

An estimated 321,294 homes across Colorado valued at $141 billion are at risk of being destroyed by wildfires, according to a new report that influences how insurance companies set rates.

CoreLogic’s 2024 Wildfire Risk Assessment comes as insurance companies increasingly rely on technology to help them determine how big the wildfire risk is across the United States and, in turn, how much they need to charge homeowners to cover those risks while still turning a profit.

The problem, according to consumer advocates and industry regulators, is these modeling systems do not account for all of the mitigation work being done to protect properties from fires. It’s a problem Colorado Insurance Commissioner Michael Conway is trying to solve.

“What the majority of them don’t do at all is incorporate state-level or community mitigation,” Conway said. “They have been telling homeowners they have to mitigate to keep insurance affordable and available. But if they’re not going to take that into account, that’s a very big problem.”

Colorado homeowners have seen their insurance costs escalate faster than the rest of the country because of wildfires and hailstorms, according to a 2023 Colorado Department of Insurance report that looked at rates between 2018 and 2022. At least one analysis found home insurance rates increased in the state by 19.8% between 2021 and 2023.

The increasing costs are not just impacting those whose homes are at risk of burning in a wildfire. Every property owner in Colorado will pay more so insurance companies can cover their risk when a catastrophe happens elsewhere in the state. That makes people’s monthly mortgage payments go up as most homeowner insurance is paid by their banks through escrow accounts.

The increase also affects renters as landlords will charge tenants more to pay for their expenses.

Those rising rates are being driven by increased wildfire risk — a result of a warming climate — and inflation, said Amy Bach, executive director of United Policyholders, an advocacy group for consumers. But new technology that provides insurers with maps, graphics and piles of data also are contributing to enormous increases, she said.

The latest wildfire risk assessment was produced by CoreLogic, a tech company that creates risk assessments for wildfires and other natural disasters. But CoreLogic is just one of a handful of companies producing such assessments by using artificial intelligence, drones and mapping, Bach said.

For example, Verisk Analytics’ most recent analysis on the cost of home reconstruction after a disaster, which also is used by insurance underwriters, reported that Colorado had the second-highest increase in post-disaster reconstruction costs in the country, behind only New Hampshire. The cost to rebuild a house rose 9.05% in Colorado between July 2023 and July 2024, the analysis found. Colorado also had the second-highest jump — 11.57% — in rebuilding commercial properties.

“In the beginning, I thought it was climate change driven,” Bach said of rising homeowners insurance costs. “But now I believe it’s the tech factor that is equally causing a dramatic shift in the market.”

Wildland urban interface

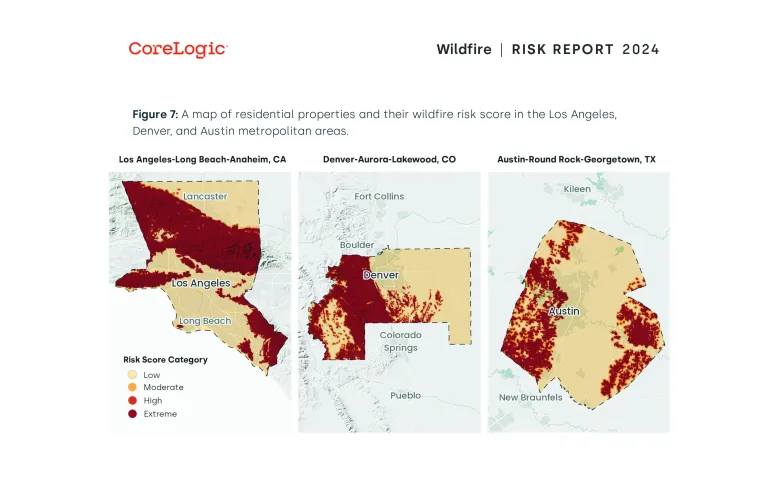

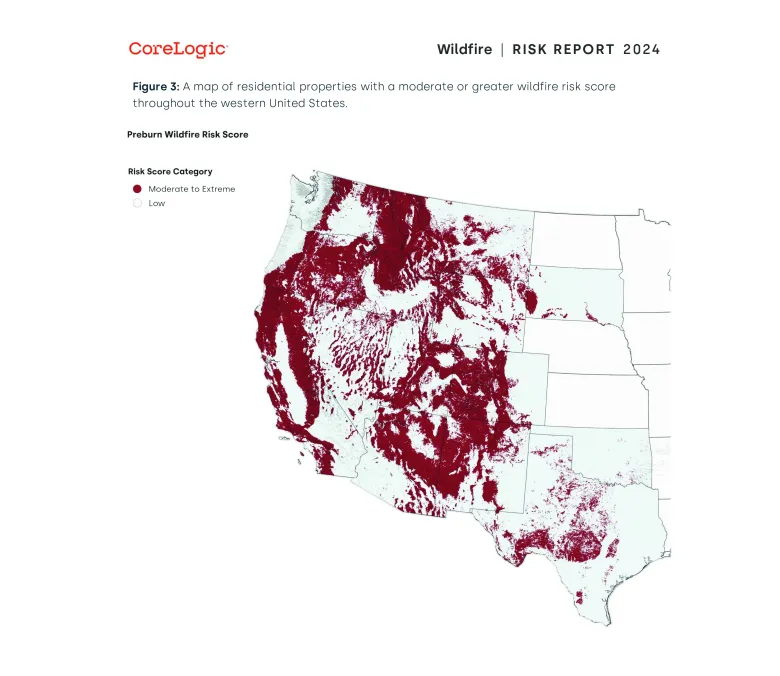

CoreLogic’s 2024 Wildfire Risk Assessment estimated that 2.6 million homes in the western United States are at least at moderate risk of burning in a wildfire, and the cost to rebuild those homes would exceed $1.2 trillion. Colorado ranked second with the most homes at risk while California was first and Texas was third, the assessment stated.

In Colorado, 68,928 properties in metro Denver are at risk along with 50,298 in the Colorado Springs area. Most of the homes in the state that are threatened by wildfire are in what insurance companies and firefighters call the wildland urban interface — in other words, houses built near open spaces or on the outskirts of mountain towns such as those that burned last month in the Stone Canyon fire near Lyons and the Alexander Mountain fire west of Loveland.

That growth around the wildland urban interface is contributing to rising insurance costs in Colorado.

Insurify, a digital insurance agent that compares quotes from more than 100 agencies, found that Colorado’s average annual home insurance rate is expected to increase by 7% to $4,367 in 2024 from $4,072 in 2023. In 2023, Colorado’s average home insurance rate was $1,695 higher than the national average.

Colorado’s continuing popularity and people’s desire to live near the mountains and foothills contribute to the state’s high ranking in the CoreLogic report, said Jamie Knippen, a senior product manager for the company. Since 2010, the number of homes built in Colorado in the wildland urban interface has increased 45%, she said.

“So as people have moved and development has increased within these areas, risk has also grown just due to the number of homes and the value of those homes,” Knippen said.

CoreLogic started producing the wildfire risk assessment in 2019 to help insurance companies figure out the risk they would take on when selling policies to homeowners in different areas of the country, Knippen said. The company also writes risk assessments for hurricanes and floods in other parts of the U.S.

The company wants to report accurate data so insurance companies and the general public understand risks, Knippen said. The risk assessment should start conversations about the perils homeowners face and how they can be taken into consideration when it comes to decisions such as buying a new house or protecting the ones people already have.

Carole Walker, executive director of the Rocky Mountain Insurance Association, said the various data reports generated by tech companies are really reflecting what insurance companies already know — hot, dry weather in Colorado is increasing the chances of wildfires and still people are building expensive homes in the mountains.

She disputed arguments that the various analyses cause rates to go up.

“What it really does is provide accuracy, first and foremost, for what your risk is,” Walker said.

Modeling isn’t new

Computer modeling for wildfire risk is fairly new to the industry, Walker said.

It is much more sophisticated than years ago when a homeowner would talk with their insurance agent about how far they lived from the nearest fire station and where fire hydrants were located in neighborhoods. Now, drones, satellite imagery and other data points can help analyze the slope on which a home is built, the vegetation around the house, construction materials and, yes, the distance to the closest fire station.

Those models also are helping with the science of mitigation, which is an increasingly big part of reducing wildfire risk, she said.

That means homeowners do as much as they can to reduce the chances their houses will burn in a wildfire. It involves everything from upgrading roofs to moving wooden fences farther from houses to clear-cutting dense brush around the perimeters of homes.

But that’s where the fight is centered. If insurance companies are going to ask homeowners to mitigate risk, then the homeowners should receive discounts for that work, Conway said.

So far, the risk analyses and modeling programs that insurance companies rely on are not taking into account all that work, he said.

For example, Colorado deployed a Firehawk helicopter for the first time to fight blazes that sparked this summer in Boulder, Jefferson and Larimer counties. The state’s Division of Fire Prevention and Control also has airplanes to map fires and carry water and retardants to extinguish them. Those aviation assets saved valuable property.

But the state and its homeowners do not get credit in risk assessments for those airplanes and the helicopter, Conway said.

The models also don’t take into account all the work that communities such as Boulder County have done to help reduce the level of destruction a wildfire can cause. For example, Boulder County collected $8.9 million last year through a sales tax dedicated to wildfire mitigation that funds projects such as using goats to graze on open space in Superior.

The same fight is happening in California, Bach said. It’s impossible to put the “tech genie back in the bottle,” so it is up to regulators like Conway to push the tech companies to change their models and predictions so mitigation efforts are included in the assessments, she said.

“That is the fight,” Bach said. “From my perspective as a consumer advocate, if you’re charging someone who has mitigated the same rate as someone who hasn’t, then you’re overcharging.”

Get more Colorado news by signing up for our daily Your Morning Dozen email newsletter.

I’m surprised it took this long! In another life, I was heavily invested in insurance for my vertical integration contract with Tyson foods. Poultry houses were about a half million each, and having one burn, collapse or blow apart would not afford much income for a farmer. I was a County Board Member for Farm Bureau, and my daughter worked for State Farm for over ten years. Neither of those things overlapped, but I learned a lot about insurance!

Insurance companies are “for profit” entities, and do not cover losses as a hobby. My expertise was farm and ranch related but even that transfers situational knowledge, associated with wildfire and hurricanes – and risk.

Some Front Range (Colorado) communities cannot even get insurance for their homes, or those insured are being dropped due to wildfire risks. When we purchased a home in Evergreen (CO), we were concerned over our ability to get homeowners insurance! We completed a lot of mitigation out of my concern for potential fire. We passed up on some really “good deals” because I would not take a risk for where some of those “deals” were located. We were insured with no problem, but that was ten years ago; investors, like insurance companies, don’t operate for practice and warm fuzzies…..

I understand that they don’t operate for warm fuzzies; still we depend on regulators to pay attention to what they are actually paying out, and not what they might have to pay out, based on models that the industry paid for.

Sharon – –

Article behind paywall of the DP. Please copy & paste full article to TSW. Excepts are confusing, Conway, Walker, Bach… can’t make heads or tails from the excerpts.

How about hiring some professional foresters – there is an excellent cadre of professional forestry consultants from the Association of Consulting Foresters in Colorado to provide the on-the-ground assessment and professional solutions for wildfire risk and mitigation prescriptions for both Insurance carriers, the insurance commission, as well as homeowners, HOA(s), and county planning commissions and county commissioners, Firewise councils and fire districts.

The Colorado Wildfire Risk Assessment Portal (COWRAP https://www.timmonsgis.com/project/colorado-wildfire-risk-assessment-portal-cowrap/) is the state sponsored wildfire risk map and is tempered from the landowner’s initial risk (unmitigated or untreated) to the risk reduction based on the mitigation or silvicultural prescription. Great tool and not biased as is core logic which only displays the forested or woodland provinces of Colorado and not the steppes dominated eastern 2/3rds of the state.

There are lots of “Cassandras” that have jumped into this fear-based market, including Walker who equates “hot dry weather…increasing the chance of wildfires.” And backwards thinking that because Boulder County relied on firehawk to save-the-day, the nick-of-time response deserves an insurance break?

sorry about that Pecos! I posted the whole thing at the end of the previous posts. Sounds like maybe you should give Amy Balch a call.

“Those rising rates are being driven by increased wildfire risk — a result of a warming climate — and inflation, said Amy Bach, executive director of United Policyholders, an advocacy group for consumers. But new technology that provides insurers with maps, graphics and piles of data also are contributing to enormous increases, she said.”…

***********

““In the beginning, I thought it was climate change driven,” Bach said of rising homeowners insurance costs. “But now I believe it’s the tech factor that is equally causing a dramatic shift in the market.”

Umm.. the “tech factor” I might call it the PBR factor (not Pabst Blue Ribbon) but Potentially Bogus modeling Results factor..