I don’t have a brain that works all that well with financial instruments, so I asked our resident forest economist, Andy Stahl, to explain how they work.

For example, here is the story I reached out to him about.

“Blue Forest, a non-profit conservation finance organization working in collaboration with the USDA Forest Service, Washington State Department of Natural Resources (Washington DNR), Chelan County, and Chelan Public Utility District (Chelan PUD), proudly announces the launch of the first Forest Resilience Bond (FRB) in the Evergreen state. The Upper Wenatchee I FRB is dedicated to funding fuel reduction activities on the Okanogan-Wenatchee National Forest, alongside crucial aquatics work. The project is financed by mission-driven investors through Blue Forest’s FRB Catalyst Facility.

“Collaboration is at the heart of everything we do and instrumental to the success of our Forest Resilience Bond model,” says Kim Seipp, Blue Forest’s Managing Director of Science and Research. “That is one reason why we, along with our partners, are excited to launch the Upper Wenatchee I FRB. Through this collaborative effort, we are catalyzing the funds necessary to ensure wildfire mitigation work starts now, not in a decade. Together, we are creating a more resilient landscape and safeguarding communities.”

The FRB, co-developed by Blue Forest, the World Resources Institute, USDA Forest Service, and National Forest Foundation, is an innovative financing mechanism that taps into private capital to finance forest restoration projects on public lands to protect communities, ecosystem benefits, and rural livelihoods.

Funding contributions from the USDA Forest Service, Washington DNR, Chelan County, and Chelan PUD will accelerate the pace and scale of wildfire mitigation efforts in these high-risk areas, completing activities that would have otherwise likely faced delays of eight to 10 years.”

It seems like a terrific idea, and reflects what I heard on an NGO call a few months ago “we can’t reach the pace and scale needed without private financing.” Not that I agree with it, but it seems to be a popular idea. Which made me reflect on the forest road needs that Mike brought up in Creede, and maybe private financing could be used for that. But what do the people financing get out of it? And why don’t the private entities just give the FS the money and write it off on their taxes?

That’s when I called on Andy. My questions are in italics.

What do the people financing the work get out of it? And why don’t the private entities just give the FS the money and write it off on their taxes?

Andy:

What you really need is an investment broker, but, I’ll take a shot at it.

First things first, here’s a handy definition of a “bond”:

Bond financing is a type of long-term borrowing that state and local governments frequently use to raise money, primarily for long-lived infrastructure assets. They obtain this money by selling bonds to investors. In exchange, they promise to repay this money, with interest, according to specified schedules. The interest the state has to pay investors on the bonds it issues for public infrastructure is exempt from their federal and state income taxes, which makes the state’s interest cost on the bonds less than it otherwise would be.

Step 1: An “investor” enters into a contract, e.g., a promissory note, with Blue Forest. Under the contract’s terms, the investor gives Blue Forest a lump sum (let’s say $10 million), which Blue Forest agrees to pay back to the investor over a longish period of time, say 10 or 20 years, at an interest rate sufficiently favorable to entice the investor, say 5-10% annually. I suspect the investor has little control over how the money is spent, although Blue Forest uses lots of cool buzz words to get the investor interested. What the investor really cares about is Blue Forest’s liquidity cash flow, i.e., will Blue Forest make its payments, and is the interest rate competitive with what the investor could make elsewhere, taking into account risk. That is, the higher the risk Blue Forest reneges on the deal, the higher the interest rate Blue Forest is going to have to pay to attract investors. I think (but am not sure) that Blue Forest persuaded the California legislature to allow Blue Forest to issue forest bonds with the investor’s interest earnings exempt from state tax, just like a California municipal bond issued by a city.

Step 2: Blue Forest then enters into contracts with “beneficiaries” who agree to borrow money from the Blue Forest Fund to pay for forest restoration work that the beneficiaries would like to see happen. The key attribute required of a beneficiary is having cash-flow sufficient to pay back the Fund’s money plus interest. Blue Forest has persuaded electrical utilities (their cash flow comes from selling power to customers) and insurance companies (cash flow comes from homeowner premium payments) to agree to pay back the Fund the borrowed money. The key point is that it is the beneficiary’s customers who actually pay back the money as the beneficiary passes through the bond costs to its homeowners and power buyers. Do the beneficiary’s customers (homeowners and ratepayers) even know they are borrowing these dollars? I do wonder . . .

Step 3: Blue Forest then contracts with an “implementation coordinator” to do the actual work in the forest. Note that the coordinator can also be a pass-through, e.g., NFF, which then hires the bubbas who do the actual brush removal work.

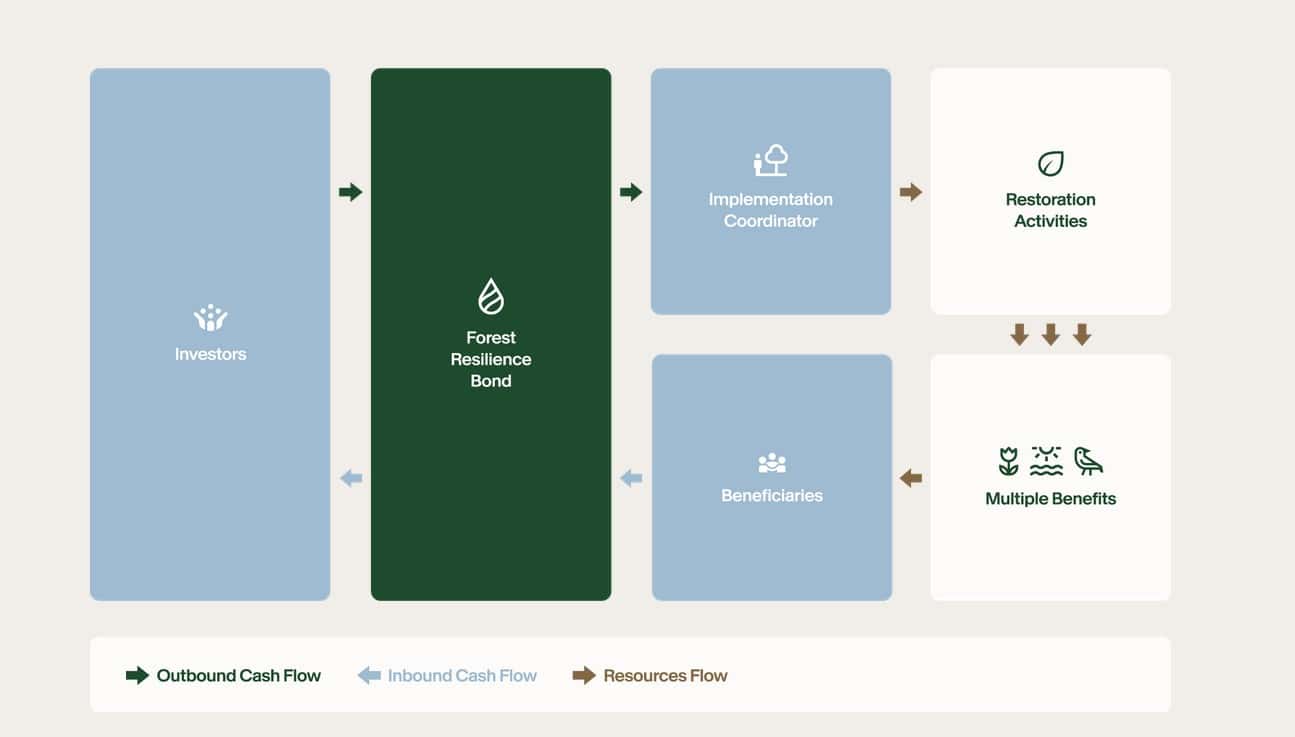

Check out Blue Forest’s money flow-chart:

Clear as mud?

Sharon: This is helpful indeed. It’s an improvement for beneficiaries rather than paying the work themselves, because… ???

The beneficiaries DO pay for the work. They pay for it on an installment plan with interest, just like owning (sic) a house with a mortgage.

However, unlike the homeowner, who actually knows she bought her own home and thought it a good idea to do so, the beneficiaries are consumers of electricity, purchased from a monopoly utility, who probably have no idea that a portion of their monthly payment is being used to thin some forest property that may be in another county. Same for the homeowner whose insurance premiums went up because the insurance company thinks it’s a good idea to thin forests, figuring that might reduce home loss pay-outs. The homeowner likely has no idea, nor any say in the matter, of whether her dollars should be used on fuel treatments far from her house.

The only entities that are sure to benefit are the investors who earn interest for the use of their money, Blue Forest, which skims administrative expenses and can get rich as there is no meaningful oversight of its staff salaries, and the implementation coordinator who gets more overhead rake-off for passing through the dollars to Bubba. Oh, Bubba makes minimum wage (if lucky) to rake the forest.

Perhaps someone has decided that getting the work done sooner is worth the insurance companies and monopolies paying the interest? Are those analyses reviewed by regulators?

Yes, the beneficiary — insurance company, utility, city government or whoever has access to a steady cash flow from consumers/taxpayers — has decided that it’s worth borrowing money now to do the work and paying the associated interest costs. Who oversees that borrowing decision? Not the ratepayers, not the homeowners, and not the taxpayers who are footing the bill. Although insurance companies and utilities are regulated by states, I doubt that state regulators drill down deeply into these types of financing decisions.

A variation on this theme, which cuts out some of the middle players (e.g., Blue Forest), is Flagstaff’s Watershed Protection Project, which is financed by a $10 million municipal bond voted on by Flagstaff residents (74% of voters approved the bond). Flagstaff property taxes pay back the bond. The City of Flagstaff uses the money to pay Bubba to rake the forest.

Note that most (all?) of the forest raking financed by Flagstaff’s property taxpayers is national forest. Analogy . . . imagine your neighbor’s property was piled high in flammable, noxious garbage, which your neighbor refused to clean-up. In desperation, you offer to pay the clean-up costs to lessen the risks to your home. Your neighbor, quite sensibly, agrees.

****************************

Now I don’t want to get all classist again, but in the interests of social and environmental justice, I’m wondering about another approach that would focus on paying people who work in the woods decent wages, and cutting out unnecessary layers of overhead. Which should be just as true for externals as for the FS (which I agree could do much better and has tried intermittently). Not to dis the people who work at these outfits, who are great, knowledgeable, and well-meaning, it’s the instrument, not the folks, I wonder about.

Does anyone know if work on the ground is getting done and the efficiency of it. To me that would be the test.

What I’ve figured out is that records are kept locally so we’d have to ask the local units.