I asked the folks on Doomberg to take a look at NACs from a financial perspective. As a non-financial person, I’ve written about them here, here, and here.

I asked the folks on Doomberg to take a look at NACs from a financial perspective. As a non-financial person, I’ve written about them here, here, and here.

Doomberg’s piece on Substack is called “Measurement Army: Natural Asset Companies (NACs): the next big grift?

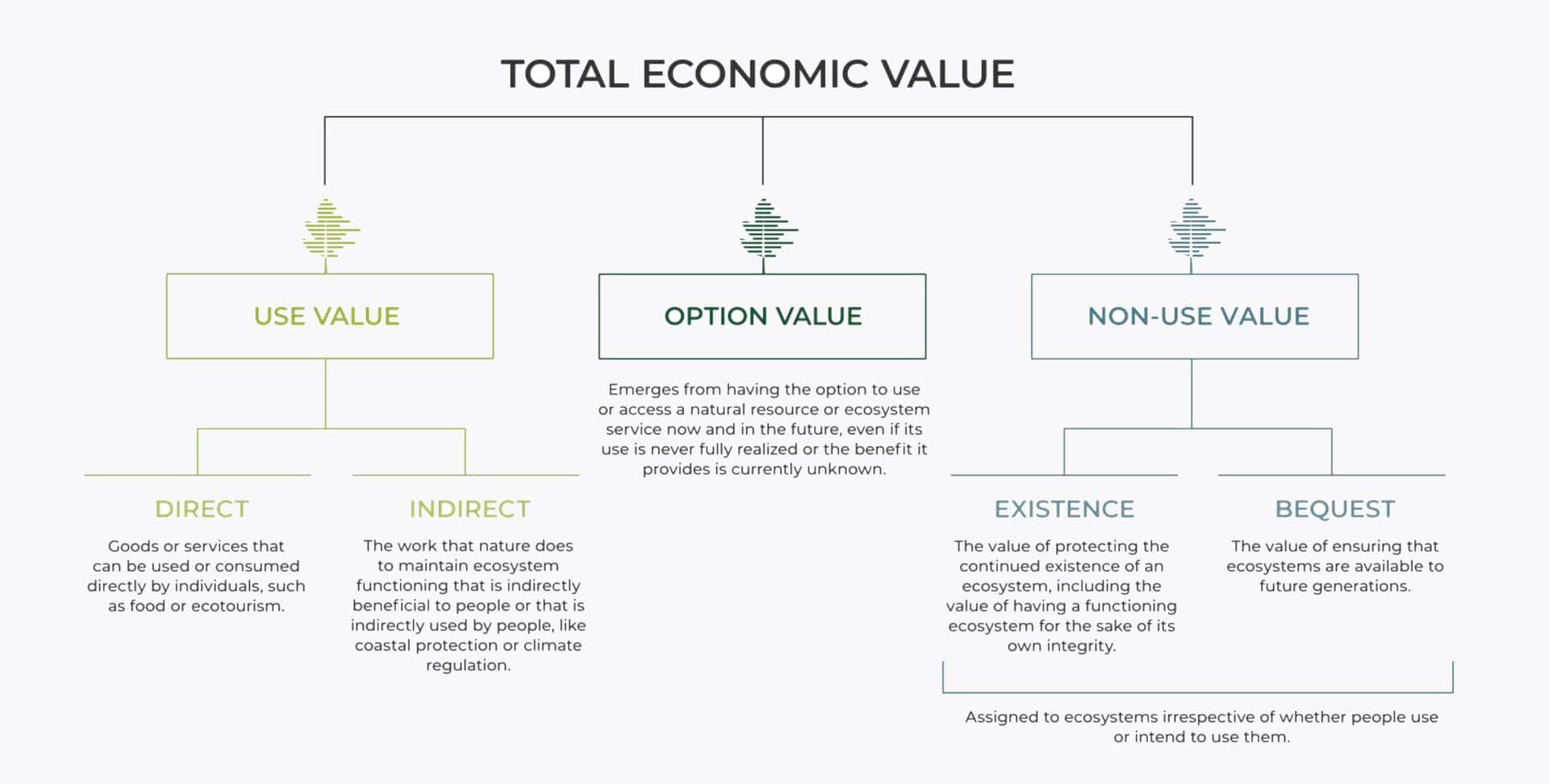

We begin with some important definitions culled from a 56-page exhibit filed with the SEC as part of the petitioning process, and from the United Nations System of Environmental Accounting (SEEA):

A “Natural Asset” is “[a] statistical representation of ecosystems for accounting purposes that defines them as productive units of ecosystem services” that can be “monetized directly or indirectly.”

“Ecosystem Services” refer to the benefits that people obtain from ecosystems and are categorized broadly into provisioning, regulating, cultural, and supporting services.

“Ecological Performance Rights” are “[t]he rights to the value of natural assets and the production of ecosystem services in a designated area, including the authority to manage the area. These rights are granted to a NAC, from a natural asset owner, as provided through a license or other legal instrument.”

Finally, an “Ecological Performance Report” is “[a] report with statistical information on the ecological performance of a NAC, including sections with data on (i) Natural Production, (ii) Natural Assets, and (iii) Underlying Asset Condition. This Report is unique to NACs and will be provided in addition to traditional financial statements.”

Let’s see if we get this right: NACs hold claim to the Ecological Performance Rights over the Ecosystem Services delivered by the NAC’s licensed Natural Assets. Think of all the measuring needed to make that construct work.

******************************

I guess this could be more abstract, but it’s already beyond my imagination. A thing is not a thing, but a “statistical representation” of a thing. I didn’t even know that there was a United Nations System of Environmental Accounting.

The authors of the SEC filing go on to claim an astonishing measurement of their own: natural assets are valued at approximately $5 quadrillion. Listing NACs on public stock exchanges “can convert the long-understood – but to-date unpriced – value of nature into equity capital which can generate the financial capital needed to manage, protect, and restore healthy ecosystems over the long term.”

Doomberg, like me, takes a dim view of the many potential transactional hogs at the trough..

Imagine the wealth creation opportunities for the cadre of sponsors, advisors, brokers, and attorneys when passive fund managers are mandated to allocate to NACs, options markets are developed for them, and retail traders give them the Nvidia treatment.

I don’t know what the Nvidia treatment is..

And then there are the measurers! All players involved in the new world of NACs – including governments, banks, law firms, and the NACs themselves – will need an army of them. Given the bulging numbers of the administrative class, this is one modern army sure to exceed its recruitment needs.

If you’re not familiar with ideas about the administrative class, you might take a look at this piece by N.S. Lyons, in which he describes what N.S. describes as the “managerial ideology.”

7. Abstraction and Dematerialization: The belief, or more often the instinct, that abstract and virtual things are better than physical things, because the less tied to the messy physical world humans and their activities are, the more liberated and capable of pure intellectual rationality and uninhibited morality they will become. Practically, dematerialization, such as through digitalization or financialization, is a potent solvent that can help burn away the repressive barriers created by attachments to the particularities of place and people, replacing them with the fluidity and universality of the cosmopolitan. Dematerialization makes property more easily tradable, and can more effectively produce homogenization and fulfill desires at scale. Indeed in theory dematerialization could allow almost everything to take on and be managed at vastly greater, even infinite, mass and scale, holding out the hope of total efficiency: a state of pure frictionlessness, in which change (progress) will be effortless and limitless. Finally, dematerialization also most broadly represents an ideological belief that it is the world that should conform to abstract theory, not theory that must conform to the world.

The saying (not attributed to PT Barnum) has never been more true…. “There’s a sucker born every minute” – https://en.wikipedia.org/wiki/There%27s_a_sucker_born_every_minute

Also never more true, There’s a “cadre of sponsors, advisors, brokers, and attorneys” ready to turn regular folks into suckers.

Maybe I’ll just sell postcards from National Parks as NFT’s showing you own a ‘non-fungible representation of ecosystems for accounting purposes that defines them as productive units of ecosystem services’. Same thing isn’t it? And they’ll be worth just as much as your silly NAC stock in a year.

This is both amazing and unsurprising, given our drive to ‘monetize’ everything. I wonder how much God is worth these days? Yikes. Thanks for covering this Sharon. s

Let’s try this first. Charge those who reduce/impair the “ecosystem services” of public lands the actual value of those services (in addition to the government’s cost of administering them). Maybe that would lead to the same result of more conservation?

I think it’s hard to ascribe value to ecosystem services..ask the economists. So $ could flow and papers be written (and have been) about different methods of calculating them..