The editor of the Flathead Beacon has a new column following up on Weyerhaeuser’s announcement last week that they were shutting down two mills and a large administrative office in Columbia Falls, Montana.

You can read: “What Changed? A lot happened between then, when Weyerhaeuser spent $8.4 billion on Plum Creek, and now” here.

It was interesting to see that in May Weyerhaeuser sold its pulp business to International Paper for $2.2 billion. So too, it was interesting to see that earlier this month Weyerhaeuser sold it’s liquid packaging unit to (Japan-based) Nippon Paper for $285 million. I didn’t know about either of those transactions.

The Flathead Beacon and most of the media coverage in Montana continues to largely ignore another important piece of the puzzle here: something called Real Estate Investment Trusts (REITs).

Ironically, Dave Skinner (sometimes a commenter on this blog) is also a regular Flathead Beacon columnist and he wrote this piece for the Flathead Beacon on REITs and the Weyco-Plum Creek merger back in December 2015.

As I recently pointed out, while Dave and I don’t agree on much, I do agree with much of Skinner’s analysis of REITs, and specifically how it pertained to the Weyerhaeuser-Plum Creek Deal.

Here are some important snips not to be missed in Dave’s article:

“That Weyerhaeuser and Plum Creek are merging might have surprised some Montanans. Not me. Why not? Well, I guess it’s time to remind everyone America’s timber beasts are dead, replaced by a new kind of beast – Real Estate Investment Trusts (REITs)….

REIT’s must pay 90 percent of untaxed annual profit to shareholders, who are then taxed 15 percent on their capital gain. All things being equal, a dollar in a REIT pays back 35 percent more to an investor than a dollar in an otherwise-identical integrated company. In the Wall Street universe, where billions chase hundredths of a point, that was a big fat hairy deal….

Significantly, America’s all-time greatest integrated timber barony, Weyerhaeuser (Weyco for short), held out the longest … in fact, lobbying Congress for tax treatment that would render the company equivalent to a REIT in terms of tax burden and shareholder return. For that effort, in 2008 Weyco scored a reduction in income tax to 17 percent, saving $182 million.

Nonetheless, with REITs paying zero – Weyco kept spinning off mills (and people) in order to get under the REIT manufacturing-asset threshold, converting to REIT in 2010….

REITs aren’t focused on timber, except as a means of generating what stockholders crave – cash.”

Regarding the notion from the Flathad Beacon editor that in 2013 “there was a level of optimism in the [timber] industry” and “housing starts were up”….I’m not sure that’s true.

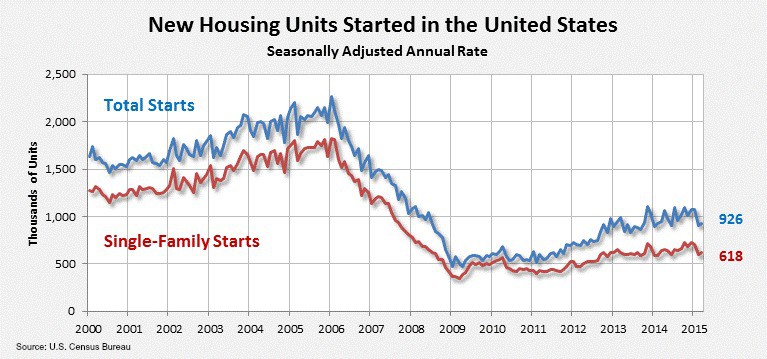

Well, housing starts may have slowly inched in a slightly upward direction by 2013, but as this chart from the U.S. Census Bureau clearly illustrates, U.S. housing starts are still just a fraction of what they once were.

A rough estimate is that during the period 2000-2006 the U.S. had about 12.45 million housing starts. During the same time frame, but from 2009 to 2015, the U.S. had about 5.95 million housing starts.

That means that the U.S. had a whopping 4.7 MILLION LESS housing starts from 2009-2015, compared with pre-housing bubble burst period of 2000-2006.

Please, let that number sink in for a second. That’s a lot less demand for 2-x4’s, plywood and building materials.

Also, in 2013 the U.S. timber industry knew full well what was coming down the pipe – the October 2015 expiration of the U.S.-Canada Softwood Lumber Deal. Of course, I can’t recall one single timber mill owner, logging lobbyist or politician telling Montana citizens about this. Nope, they were too busy telling the public how a handful of pesky “environmental extremists” were the reason for the timber industry’s problems. In fact, the public was basically keep about the expiration of the deal until the weeks leading up to it.

The Beacon did run this article in September 2015, in which the Montana timber industry finally starts to come to grips with the expiration of the Softwood Lumber Deal with Canada, and also the weak Canadian dollar, which was making the U.S. market much more attractive to Canadian timber corporations.

In fact, in that September 2015 article, Todd Morgan of the very-much pro-industry Bureau of Business and Economic Research at the University of Montana said the economic aftershock will continue to weaken the industry for some time.

“I wouldn’t be surprised to see mills taking some down time, either by shortening shifts or through curtailments,” Morgan said.

Well, that’s exactly what happened. At the end of September 2015 the Beacon reported that “Executives at Tricon Timber announced that roughly half of the mill’s workforce was being laid off Sept. 25, citing the tumultuous American timber market.”

Tricon’s VP said “said low lumber prices, the declining Chinese market and the looming expiration of the softwood lumber agreement between the U.S. and Canada all played key parts in the company’s decision.”

Even Julia Altemus, with the Montana Wood Products Association, who never misses a chance to blame environmentalists, admitted in the article:

“The state’s entire industry is struggling amid this situation. She said the industry has laid off a total of 235 positions since March. ‘People are just trying to do more with less,’ Altemus said. ‘It’s a matter of economics.’”

Also in September 2015, Julia Altemus told Montana Public Radio this:

“If you go back to March 1, about 235 lumber or mill workers have been laid off. That’s a huge hit to the industry and all the mills are suffering about a $2 million to $3 million loss in the first 6-months of the year. [It’s not] been that bad since the first part of the great recession back in 2007/2008….the markets are terrible.”

So just like the Flathead Beacon’s editor asks in his column “What Changed?” I must ask the same exact thing. What DID change from the dire situation outlined above – the results of which were entirely of the result of global economic realities and “terrible” markets.

Well, what changed in one of the largest wood products companies in the entire world came into Montana and purchased Plum Creek Timber Co for over $8 billion, making Weyerhaeuser a $25 billion new kid on the block. Weyerhaeuser’s purchased came with those 880,000 acres of (largely cut-over, entirely unsustainably logged) Plum Creek private timber lands and Weyco jumped whole hog into the REIT shell game that Skinner described so well.

What else changed? Well, we’re in the middle of a heated election cycle so of course all the politicians had to blame someone. So both republicans and democrats seized the opportunity to blame Weyco’s closures of two mills and an administrative office on “activists,” “fringe environmentalists” and the federal government.

I’ve said it before, so might as well say it again. If we’re going to continue to let politicians and big business incorrectly identify the problems, and just blame all the world’s problems on ‘fringe environmentalists,’ how in the world will we have good solutions? Or sustainable communities? Or science-based management of our National Forests, including budgets needed to do all the backlogged bona-fide restoration work?

Maybe that will change too…but I’m not counting on it.

Matt, it is litigation-crazy Greens that drove Plum Creek to a radical solution to its problems. You had TU trying to sue to stop all harvest over whatever endangered critter could be found. Then, along comes the HCP with Babbitt’s Interior, which was an amazing sellout that ended public access to much of Plum Creek, which they didn’t want to provide anyway. Reason was “bears” but the fact is, it helped Plum Creek cloak their forestry practices.

Don’t forget, Northern Pacific/BN really was a benign neglect kind of thing, wood that would go on trains and create business for the railroad. They were constrained by the gold bonds. Real estate wasn’t much of a play until after the NP gold bonds litigation in the mid 1980s and the Plum Creek creation, primarily as a real-estate play, first last and always.

Second, the HCP “legitimized” the blackmail of HCPs and extended the life of ESA. Prior to that point, PC was an ally in reform, after that, they withdrew from the battle. THEN they discovered LWCF money and the Blackfoot Challenge, all the profits to be had there.

At that time, in 1999 with the HCP, the exit strategy was fully underway, with the Montana wood cash being used to buy faster wood in less-restrictive parts of the country. Those in PCL headquarters were fully aware of the supply curve they were facing, being privy to the truth, the inventories, the actual harvest yields.

Investors cared only in the abstract, but as long as the dividends were good, no problem!

Also, don’t forget the spotted owl changed the universe in 1994. The entire Northwest wood basket became a giant, regional uncertainty under the Clinton Administration, policy on USFS geared toward wilderness and “roadless” at the same time other land bases were at risk for litigation and more listings.

The markets are one thing, but in the larger scheme of things, environmentalist litigation and bad, green-pandering policy have definitely exacerbated the region’s comparative weakness on the national scale. Granted, things might be hard, and markets are part of that, but the influence of politics and politically driven litigation cannot be minimized. The risks posed by groups like AWR, NEC, EJ, CBD and the rest of the alphabet soup drove Plum Creek to seek a way out.

Dave, while interesting, this still doesn’t address why the “litigation crazy greens” existed. You speak as if they sprung like Athena fully armored form Zeus’s brow. They were a legitimate response to the public’s opinion that they didn’t want to see their multiple use public lands managed specifically for the greatest monetary return, while the public got stuck with all the externalities.

Greens are the kids whose first word was No, favorite word was No, favorite word is still No. As for the public, when was the last time you heard an average person use “externality” in a sentence?

The public likes visually attractive, accessible forests. That’s enough for them, and USFS can’t even provide that. State and tribal forests do much better on the balance.

Of course Dave, how anyone ever counter such an incisive analysis.

And BTW, I think the public has always implicitly understood that when the privileged drink the wine, the commoner gets the shower.

Those who “follow” (read: those who have a direct personal financial conflict of interest in wagering upon favorable outcomes within uncertain, highly volatile, highly manipulated, and speculated -upon commodities futures markets including timber-as-commodity) cannot be legitimately regarded as equal opposites to the public defenders of the public commons. (Characterized by Mr. Skinner as, “litigation crazy greens”)

There exists within Mr. Skinner’s skewed depiction of necessary legal recourse, a bizarre disconnect between the difference between private investor fates and market speculator predicaments vs. public defenders. These glaring differences are a consequence of market failures and alternatively, public advocacy availing its legal recourse (an aspect fundamental to rules of constitutional republics) to the notion of the separation of powers. Such notions hinge upon the pursuit of the necessary legal recourse to legislative or executive overreach.

This becomes a necessary pursuit of democratic principles on the one hand, but by Mr. Skinner’s depiction, becomes an opportunity for personal expressions of bigotry.

intolerance of different points of view may have been popularized by Trump, but that doesn’t mean such notions are legitimate.

Intolerant? Bigotry? You have 50 trigger cards left, maybe fewer as I didn’t hunt them down.

But the fact remains that enviros seem to be intolerant and bigoted against the kind of activity that is worth the while of participants. Forestry requires effort, not all of it joyful, and therefore requires some means of compensation. Even, eeeeeek, profit that pays taxes and supports administrative overhead so the forestry has a nice social outcome, manifested as attractive forests that the public likes to look upon. You know, art?

The people litigating now are the scorched-earthers in a literal sense, not just ideologically. They are fundamentally so against productive capitalist enterprise (which is necessary for work to support itself) that they can tolerate nothing but their own stop-the-wagon zealotry.

Someone’s gotta pay for this stuff. You can’t expect your Soylent Green to keep coming unless somebody grinds up the raw material.

No, what we ended up with is the extremes on each side. Most knew that the private forests lands were being harvested at a rate that would lead to a gap in available timber. But if they hadn’t been those mills and others would of closed much sooner. That is what happens when 20% of the forest land, private, produces 98% of the timber. One can only guess what our forests, and employment landscape would of looked like if we would of had a more balanced approach.

That’s not a guess, Bob. Every acre of state and a lot of tribal shows what a more-balanced, less-litigated-by-extremist-freaks or less-slicked-by-rapacious-greedniks forest can be.